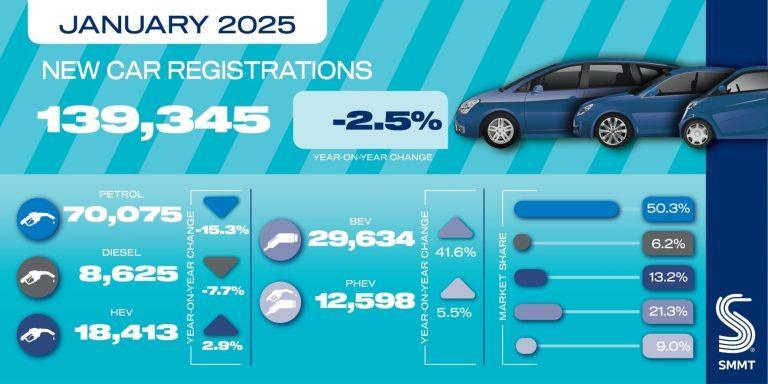

EVs take more than a fifth of new car registrations as overall market contracts by -2.5% to 139,345 units.

Slowdowns recorded by both fleet and private buyers against backdrop of weak economic confidence.

Industry calls for halt to EV tax hikes as latest outlook anticipates 23.7% market share for 2025 below government targets.

The UK new car market fell by -2.5% to 139,345 units in January, according to data released today by the Society of Motor manufacturers and Traders (SMMT), as weak consumer confidence and tough economic conditions combined to deliver the fourth consecutive month of decline.

Registrations by both fleet and private buyers were down in the month, by -3.7% and -0.5% respectively. Business registrations rose by 2.4% although, as a very small portion of the market, this translated to just 55 additional units.

Reflecting a continuation of ongoing trends, petrol car registrations dropped by -15.3% to comprise just over half (50.3%) the market, with diesel down -7.7% to claim a 6.2% share. Both hybrid electric vehicles (HEVs) and plug-in hybrids (PHEVs) recorded volume growth and saw their market shares rise to 13.2% and 9.0% respectively. Battery electric vehicle (BEV) registrations, meanwhile, continued recent growth trends, with volumes up by 41.6% year on year to take a 21.3% market share.

Despite the increase in the month, BEV market share still remains short of the 22% target set by government for last year, and even further behind the 28% requirement for 2025. This gap between demand and ambition is why the review of the Vehicle Emissions Trading Scheme and its flexibilities is essential and must deliver meaningful changes urgently, else there will likely be significant negative consequences for the market, industry and, potentially, the consumer.

Significant manufacturer investment both in new products and, last year, more than £4.5 billion worth of discounts, helped many drivers make the switch, but more consumers are still reticent, looking for greater encouragement from government and elsewhere. Private retail buyers still lack a meaningful fiscal incentive to buy an EV and, moreover, the application of the Vehicle Excise Duty ‘Expensive Car Supplement’ (ECS) to BEVs in just two months comes at the worst time for the industry. It means EV models costing more than £40,000 – the majority on the market, given higher production costs – will incur a £3,110 tax bill over the first six years of ownership – compared with zero at present.1 The change will impact both the new and used car markets, undermining the goal of a mass market transition. As a result, the industry is calling for tax plans to be revised to ensure the system is fair and avoids dissuading those who want to buy an EV.